Material

Where physical constraints quietly limit growth.

- Capital intensity

- Energy dependency

- Supply chain position

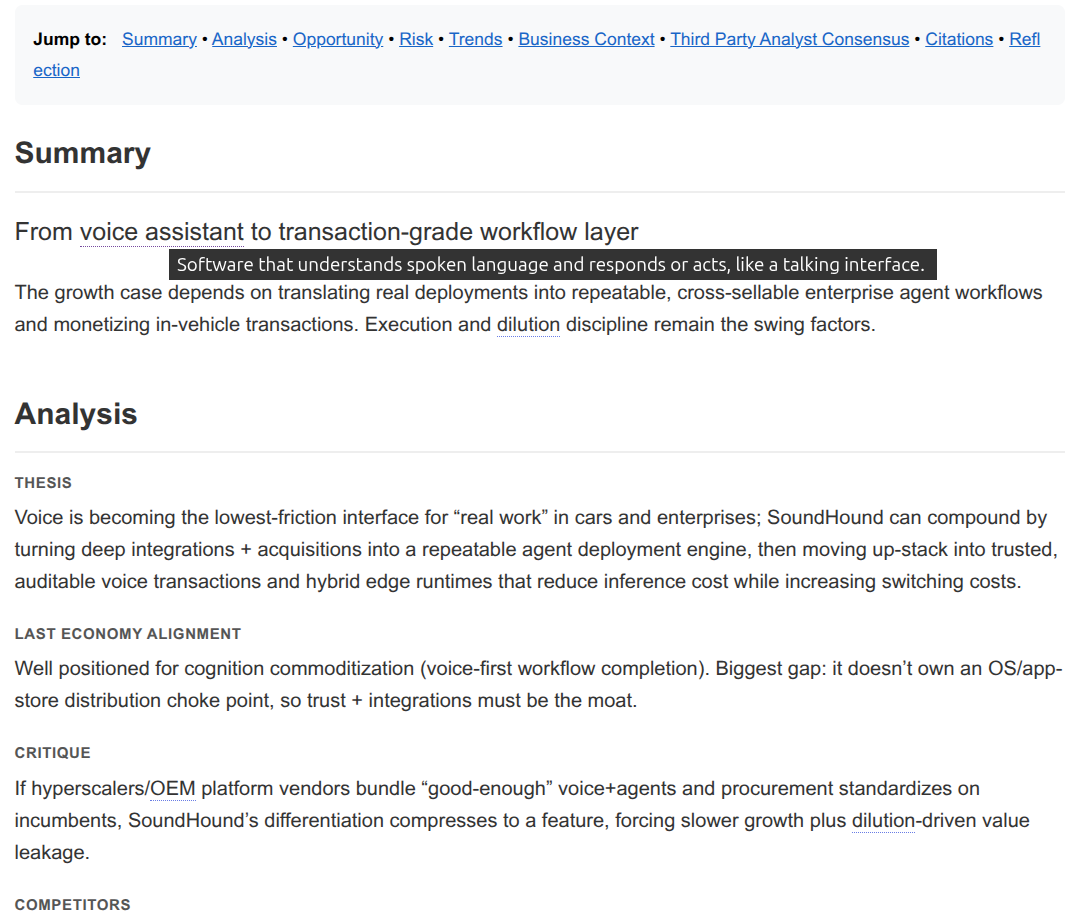

As cognition, coordination, energy, and capital constraints shift, structural advantages are forming — invisible in current financials. We track where that positioning precedes earnings proof, with explicit assumptions and clear invalidation paths.

Mechanism-first research for investors who want falsifiable claims, not hot takes.

Independent research publication • Not a broker-dealer • Not a financial advisor • No personalized investment advice

No performance claims • No trade alerts, price targets, or buy/sell signals • Investing involves risk, including loss of principal

7-day free trial on paid tiers • Free tier needs no card • Trial, renewal, and cancellation terms are shown at Patreon checkout

Next Arc Research is weekly-refreshed structural analysis for investors asking what compounds beyond the Mag 7 — tracking where cognition, coordination, energy, and capital constraints are loosening, who controls the gates, and what would change our mind.

Educational research only — nothing here is a recommendation to buy or sell any security.

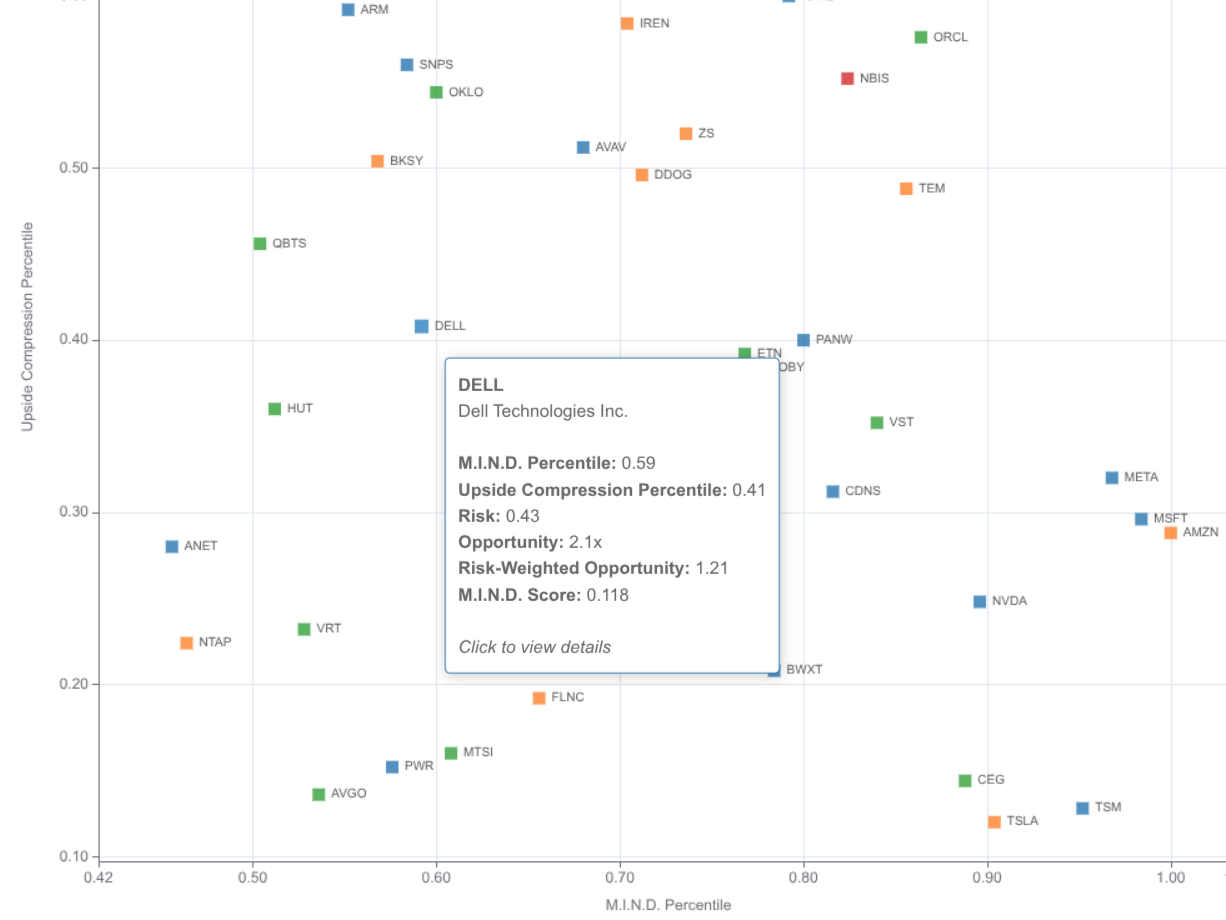

M.I.N.D. is how we identify structural positioning that precedes earnings proof — tracking which companies are building durable advantages the market hasn't priced.

Where physical constraints quietly limit growth.

Where capability compounds faster than models assume.

Where distribution and switching costs solidify moats.

Where optionality hedges the wrong future.

When structural positioning moves ahead of financials, the evidence is there — if you know where to look.

This is the kind of work you get — every week. See the latest weekly preview.

Written for investors who think in constraints, control points, and compounding horizons.

Built by engineers — not newsletter churn.

Choose the level of depth you want — access is fulfilled via Patreon tiers.

Subscription provides access to educational materials and tools only - no personalized advice or financial services - we are not a registered investment advisor or financial service provider.

All paid tiers include a 7-day free trial. No credit card required for the Free tier.

Checkout via Patreon • cancel anytime • instant access

You want to understand where the AI-era economy is heading—without trading it.

You follow AI, compute, biotech, quantum and infrastructure to understand the future, not to trade every move. You prefer clear thinking over hot takes, and frameworks over headlines. You’re comfortable with uncertainty, but want help separating signal from noise.

If you’re here to build long-term intuition rather than positions, this tier should feel natural.

Checkout via Patreon • cancel anytime • instant access

You seek deeper understanding of market structures and trade-offs.

You think in terms of market structures, trade-offs, and opportunity cost. You care about where value actually accrues, and how narratives collide with capital structure, execution, and constraints. You’re less interested in excitement than in what compounds.

If you often ask “Does the market view align with its real risks and leverage?”, you’re likely an Allocator.

Checkout via Patreon • cancel anytime • instant access

You design portfolios and frameworks, not just positions.

You think in systems: how portfolios fit together, how exposure accumulates, how risk clusters, and how theses evolve over time. You value frameworks that can be reused, stress-tested, and adapted—not just read.

If you see investing as an ongoing construction process rather than a series of bets, this tier is designed for you.

If you’re looking for quick trade ideas or alerts, this isn’t designed for that.

A structured weekly update covering market context, sector movements, and company-level structural analysis. Higher tiers include full thesis cards, M.I.N.D. scores, risk assessments, and access to interactive tools.

No. This is research and analysis for educational purposes only. We do not provide investment recommendations, and nothing published should be construed as advice to buy, sell, or hold any security.

We focus on structural analysis — identifying where constraint shifts in cognition, coordination, energy, and capital create positioning advantages that precede earnings proof. We don't chase momentum, earnings beats, or short-term price movements.

It's when constraint shifts — in cognition, coordination, energy, or capital — are reshaping a company's competitive position, but that advantage is invisible in current financials. As evidence accumulates, the market may reprice — but outcomes vary. This is analytical observation only, not a prediction or recommendation.

Yes. View a sample week preview to see how we think or join the Free tier (no card required) and choose to upgrade later.